The pound rose to its highest level in more than two years against the dollar after the Bank of England held interest rates steady and said it won’t rush to ease policy.

The currency strengthened as much as 0.8%, surpassing $1.33 for the first time since March 2022. Gilts slipped and money markets pared wagers on the extent of BOE interest-rate cuts this year, with 42 basis points of easing seen through December compared with 50 basis points before the decision.

“Everything here says it’s likely to be a gradual quarterly pace of rate cuts at best,” said Jordan Rochester, head of macro strategy at Mizuho International. He expects sterling to keep performing against the dollar, putting a break above $1.34 by early October and $1.40 by the end of next year on the cards.

BOE Vows Gradual Approach to Easing as Rates Held in 8-1 Vote

Thursday’s rally adds to sterling’s outsized gains this year, making it the best-performing Group-of-10 currency so far in 2024. Even though investors expect the BOE to ease policy again in November, they’re wagering on persistent price pressures in the UK keeping sterling borrowing rates relatively lofty compared with peers.

QT Pace Maintained

The BOE also announced it would maintain the pace at which it’s reducing its balance sheet of bonds at £100 billion per annum, something the market had broadly expected.

Gilts dropped modestly across the curve, with the 10-year climbing two basis points to 3.87%, the highest since early last week.

The BOE’s quantitative tightening plan implies “a much smaller amount of active gilt sales,” said Jessica Hinds, a director in Fitch Ratings’ economics team. “While bank reserves are currently well above estimates of minimum required levels, today’s announcement suggests that the MPC wants to keep the path of total reduction predictable given the large amount of gilts maturing over the next 12 months.”

Sticky Inflation

Data earlier this week showed services inflation, a key gauge that has worried the BOE, rose to 5.6% in August from 5.2% in July. The headline figure held at just above the BOE’s 2% target. Swati Dhingra, the committee’s most dovish member, was the sole voice backing an immediate quarter-point reduction this week.

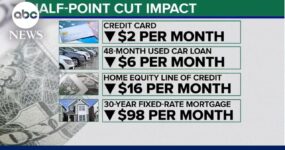

The extent of BOE easing seen by markets is much less than in the US, where money markets point to another 70 basis points of cuts before year-end after the Federal Reserve kicked off its easing campaign with a large, half-point move on Wednesday.

Laura Cooper, global investment strategist at Nuveen, said the BOE would likely catch up with the US through next year. UK growth looks sluggish and the Labour government is expected to raise taxes and cut public spending at its Oct. 30 budget, which she said could warrant a more aggressive easing cycle.

“As focus turns to the fiscal backdrop and the upcoming October budget, the Bank of England’s reluctance to follow major peers in a swifter cutting cycle will be challenged,” Cooper said.

Against that backdrop, Nuveen said she remains comfortable having exposure to UK rates and “reluctant to lean into the recent GBP/USD run-up.”

–With assistance from Vassilis Karamanis, Greg Ritchie and Anchalee Worrachate.